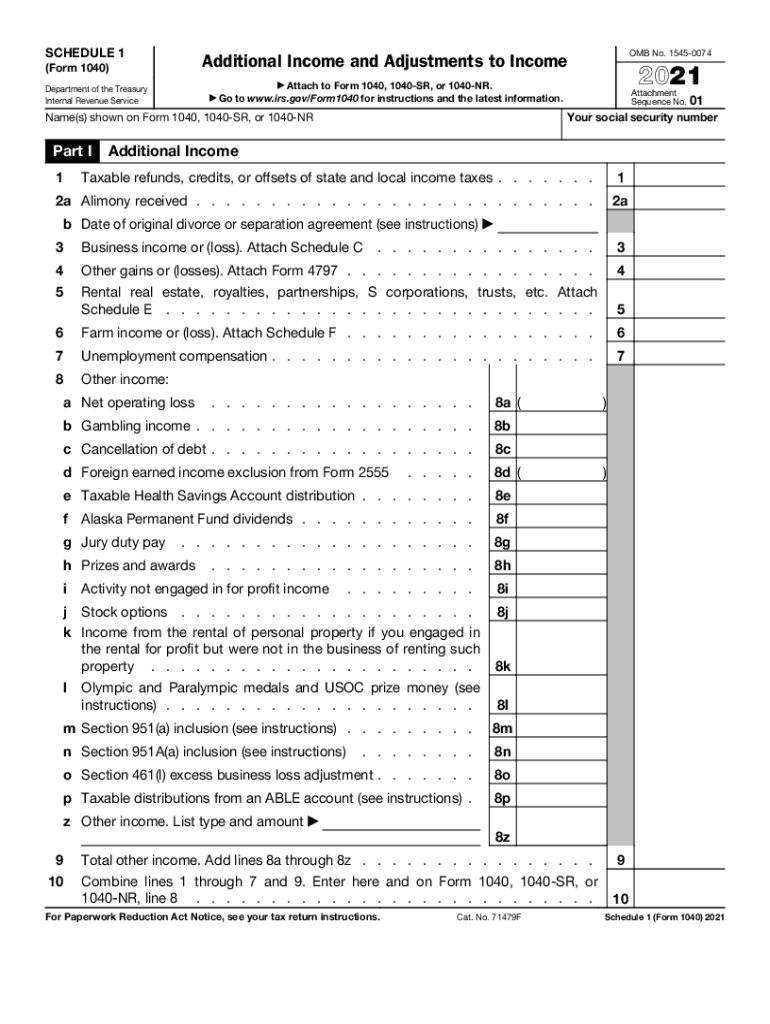

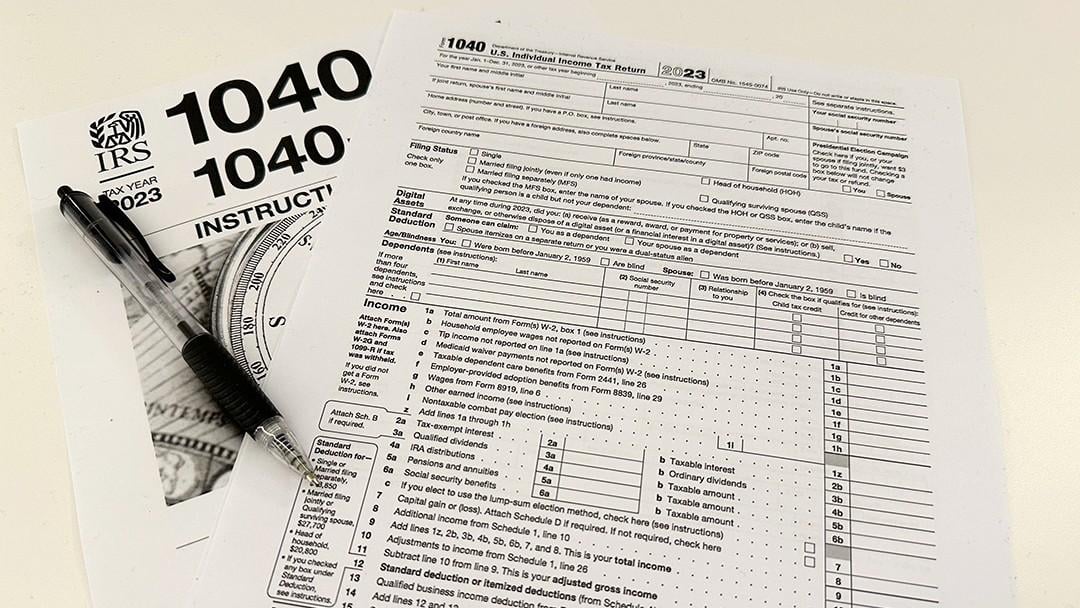

2024 1040 Schedule 1 Instructions Meaning – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the are not listed on the standard Form 1040. It includes sections for reporting . Recent changes to Form 1040 mean different filing options for seniors Form 1040-SR uses the same line items and instructions as the Standard Form 1040. Don’t worry about knowing tax rules. .

2024 1040 Schedule 1 Instructions Meaning

Source : m.youtube.com1040 (2023) | Internal Revenue Service

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.comTax Season is Under Way. Here Are Some Tips to Navigate It

Source : news.wttw.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comTax season is under way. Here are some tips to navigate it.

Source : www.wiproud.comThe Wall Street Journal on LinkedIn: What the 2024 Capital Gains

Source : www.linkedin.comWhat is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com2024 1040 Schedule 1 Instructions Meaning IRS Schedule 1 walkthrough (Additional Income & Adjustments to : The amount is added as “gambling income” on line 8 of your Form 1040, Schedule 1, which is used to report types of income not listed on the primary 1040 tax form. That total is then added to Form . claiming it as “gambling income” on line 8 of Form 1040, Schedule 1. Itemized deductions can be reported on Schedule A of Form 1040. The 2023 tax-filing season kicked off on Jan. 29, 2024 .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)